Maybe! But, is it the final answer? The challenge, as I see it today, is a shortage of homes available for sale at the entry end of the spectrum. Homes normally purchased by first-time and low to moderate income home buyers. These would be the ‘first rungs’ of the housing ladder.

Maybe! But, is it the final answer? The challenge, as I see it today, is a shortage of homes available for sale at the entry end of the spectrum. Homes normally purchased by first-time and low to moderate income home buyers. These would be the ‘first rungs’ of the housing ladder.

With many existing homeowners having refinanced and now staying put in the mid to upper-value range homes, those at these ‘lower rungs’ are finding it difficult to move up. Without the ‘lower rung’ homes moving up there will be fewer of these type homes on the market.

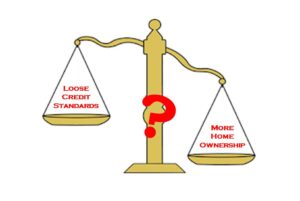

It’s not that there aren’t loan programs for which they can qualify; it’s that there aren’t enough homes for sale. Loosening credit standards could make things worse by qualifying some potential buyers for homes they really can’t afford. We know where that got us.

So, the idea is to find ways to increase supply to match demand. How can that be done?

One way is through a slight modification through FHA. Not by cutting premiums, reducing acceptable credit history and scores, or lowering down payment but by an expansion of the current FHA 203K rehab program.

All FHA loans should require a supplemental rehab loan amount sufficient to bring the home, purchased and financed through FHA, up to current housing standards.

Most homes purchased through FHA are older homes in urban areas. These are homes in need of the most repairs and upgrading.

Further, buyers have limited resources for down payment and monthly obligations. They need a home with minimal upkeep costs. This can be done through upgrading.

The separate cost of the upgrading can be financed into the loan, like a standard 203K, or provided as a grant which need not be repaid, depending upon each buyer’s financial profile and resources.

Funds for these grants can come from carve-outs to existing city block grant programs, as well as allocations made from the FHA insurance fund which may exceed the minimums required.

An additional benefit to FHA would be that if a borrower defaults on the home, that home should need less repair and upgrading for resale.

Such a program brings back into play our aging inner city housing stock, rebuilding neighborhoods while providing available upgraded homes to those who need to climb those ‘first rungs’ of the housing ladder. With these rungs replaced, everyone will have a better chance of climbing the ladder to homeownership success.

We have the buyers, we have the lenders, we have the programs, and we have the financing. All we need are the homes!

Next, we need the incentives for small builders to rebuild/rejuvenate entire inner city areas…