Twenty-twenty, the year of the refinancing boom, reflected a profile of lower mortgage fraud risk. However, purchase loan fraud increased 9% over the prior year.[1] Another industry study also indicated that in the second quarter of 2020, one in 126 purchase applications showed indications of fraud.[2]

As we roll into 2021, and by all estimates flip to a purchase market, we are likely to start to see a profile of higher mortgage fraud risk. Purchase originations are expected to hit a record $1.56 trillion, surpassing the previous high from 2005 of $1.51 trillion.[3] A rise in this volume will bring a rise in fraud incidents and along with it added risk for lenders. Compound that with the seller’s market we continue to be in, and that risk may be intensified with borrowers increasingly falsifying information on their applications to win the bid.[4]

From an investor standpoint, given the sheer volume of loans they deal with in a given transaction, there is even more at stake when it comes to mitigating fraud risk. To achieve that, many investors have requirements in place whereby a fraud report must be included on all loans being acquired. In non-delegated scenarios, where the investor is doing the credit underwriting, they may also opt to invest in fraud tools and their own reports to evaluate risk using their own preferred indicators in their searches (i.e. things like bankruptcy data or borrower involvement with additional loans within the prior 180 days).

Whichever the scenario, automated rules-based audit platforms that have tight-knit integrations with fraud detection and verification vendors offer investors an comprehensive, quick and easy way to identify red flags on a given loan prior to purchase.

LoanLogics’ loan quality management platform, LoanHD®, is fully integrated with PitchPoint Solutions, an industry leading fraud detection and loan misrepresentation verifications services vendor. Within a couple of clicks in a pre-funding review, auditors can initiate a request with the verified, validated loan file data required, have a complete fraud analysis performed and attach a report to the file all within minutes. A succinct process for investors who are on the clock to achieve a rapid turn-time.

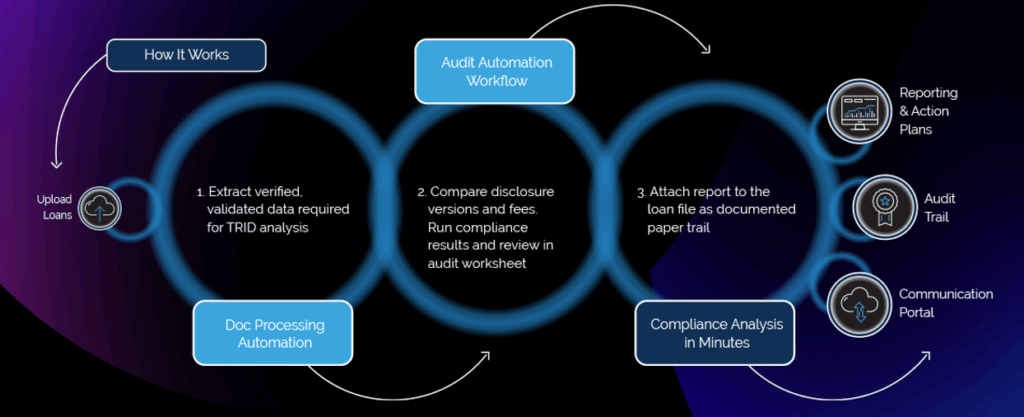

How does it work?

Our doc processing automation, LoanLogics Intelligent Data Extraction & Automation (IDEA), compares data across documents and systems to ensure auditors are using the most accurate data in the fraud analysis. This data is then pulled directly into the LoanHD automated audit workflow to be reviewed and validate by exception. Guided by color-coded indicators and one-click access to the source from which the data came, auditors can quickly resolve any data discrepancies. Auditors can then request a PitchPoint application data validation report (ADV) through an automated request. Once the report is returned, the tests are added to the audit and reviewed by the auditor. The PDF report remains attached to the loan file for future reference. Loans that do not meet the investor’s guidelines can be withdrawn from purchase or addressed with the seller.

Investors can then take advantage of LoanHD’s centralized reporting where all the results can roll up into a single database and carved up into a series of reports to analyze. Root cause of defects, trends and areas of responsibility can all be easily identified as needed with the push of a button. Centralized reporting also creates an audit trail of information to present to regulators should an examination occur.

The PitchPoint ADV report integrated with LoanHD provides investors comprehensive verification on identity, application, and property insights including:

- ID Validation & Address History & Ownership

- Employer ID

- Subject Property

- MERS Liens

- Watch List Reports

- Neighborhood Factors

- FEMA Declared Disasters

It is also highly customizable and can be tailored to the investor’s interests. User-friendly color-coded pass/fail indicators help guide auditors through the assessment.

If you’re an investor looking to acquire more loans with less risk in 2021, we invite you to learn more about LoanLogics’ services, Pre-Funding audit technology and integration with PitchPoint. Reach out at loanlogicsinfo@loanlogics.com or request your product introduction here.

[2] https://www.housingwire.com/articles/amid-record-volumes-mortgage-fraud-risk-is-down-heres-why/